beta formula for finance using excel

Multiplied by a beta of 15 this yields 9 percent. There are then two ways to determine beta.

Beta Formula Calculator For Beta Formula With Excel Template

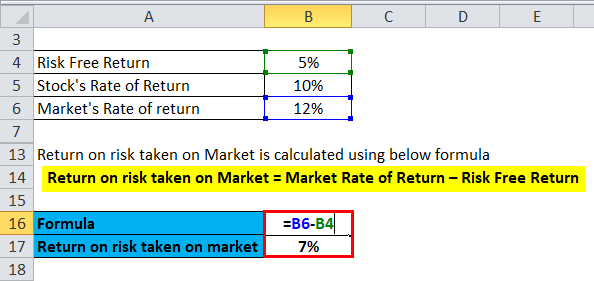

Cost of equity Risk free rate of return Beta market rate of return - risk free rate of return.

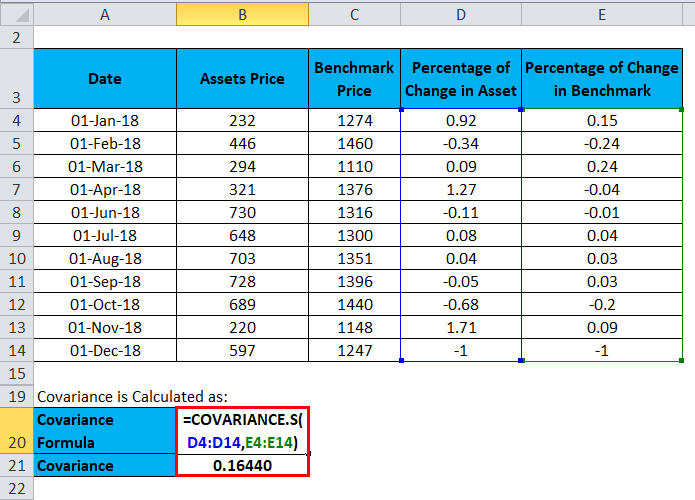

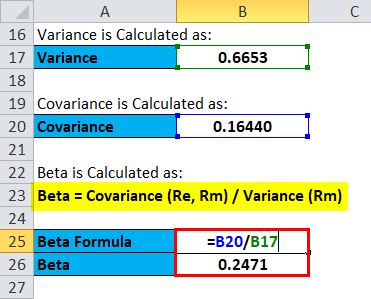

. Now for the same parameters find the beta probability distribution using the cumulative argument as FALSE as shown below. The greater the absolute value of the beta coefficient the stronger will be the impact. Beta Formula Covariance Ri Rm Variance Rm Covariance Ri Rm Σ R in R iavg R mn R mavg n-1 Variance Rm Σ R mn R mavg 2 n.

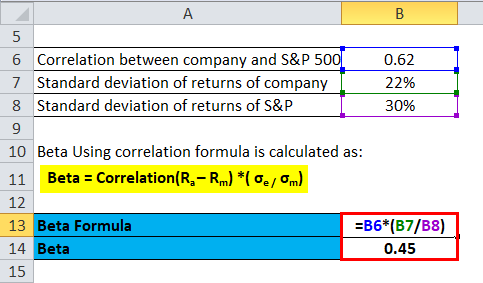

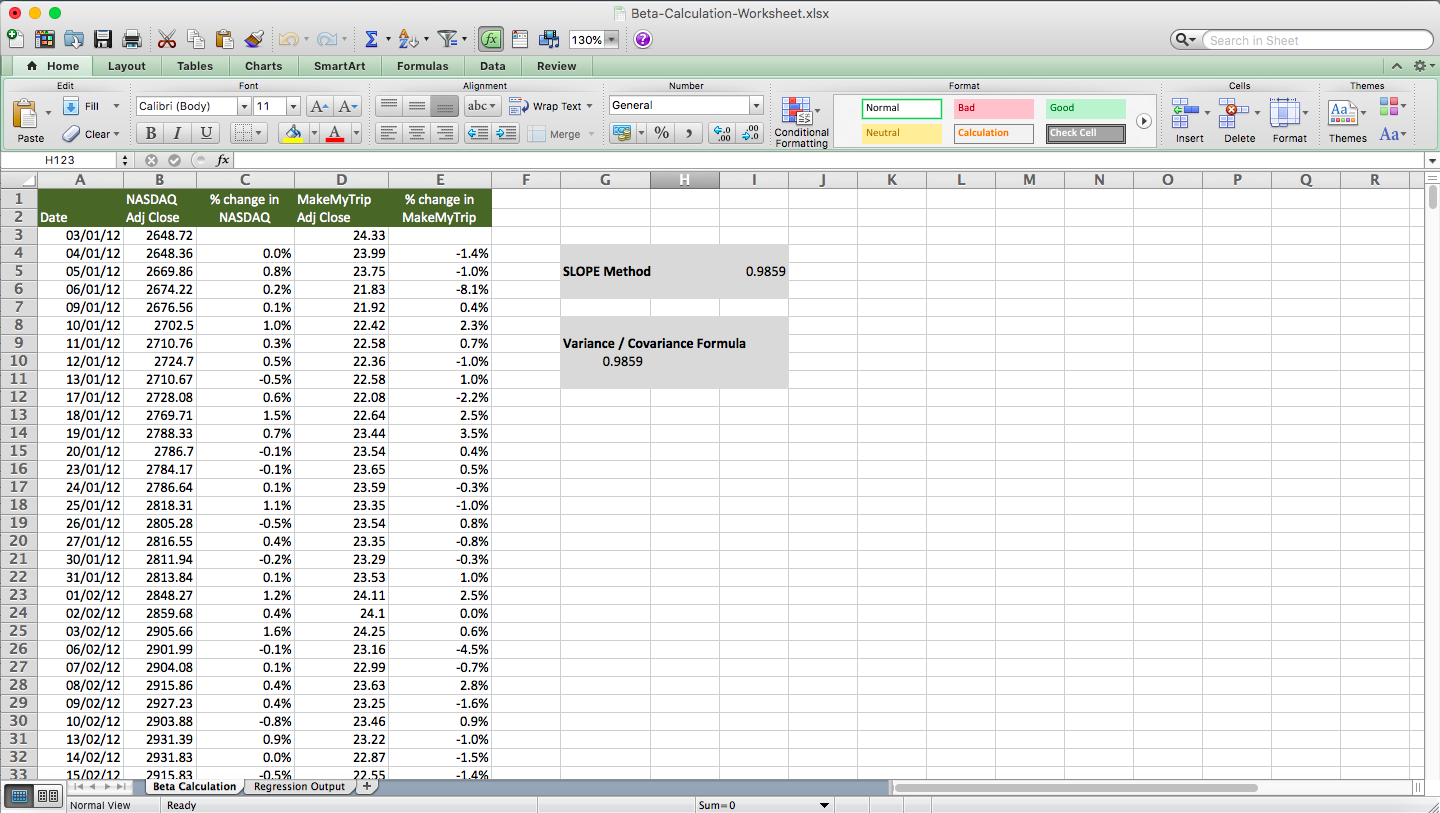

The first is to use the formula for beta which is calculated as the covariance between the return r a of the stock and the return r b of the index divided by the variance of the index over a period of three years. In the spreadsheet we first estimate the historical beta and then adjust it. Unlevered Beta Levered Beta 1 1 Tax Rate Debt Equity Unlevered Beta 08 1 1 30 200 million 400 million Unlevered Beta 059.

Perform financial forecasting reporting and operational metrics tracking analyze financial data create financial models the SLOPE function can be used to calculate the beta of a stock. Here is a classic formula for calculating the Beta Coefficient. Unlevered Beta is calculated using the formula given below.

The method is similar to the Vasicek adjusted beta. Using 2 percent for the risk-free rate and 8 percent for the market rate of return this works out to 8 - 2 or 6 percent. The Capital Asset Pricing Model CAPM estimates beta based on.

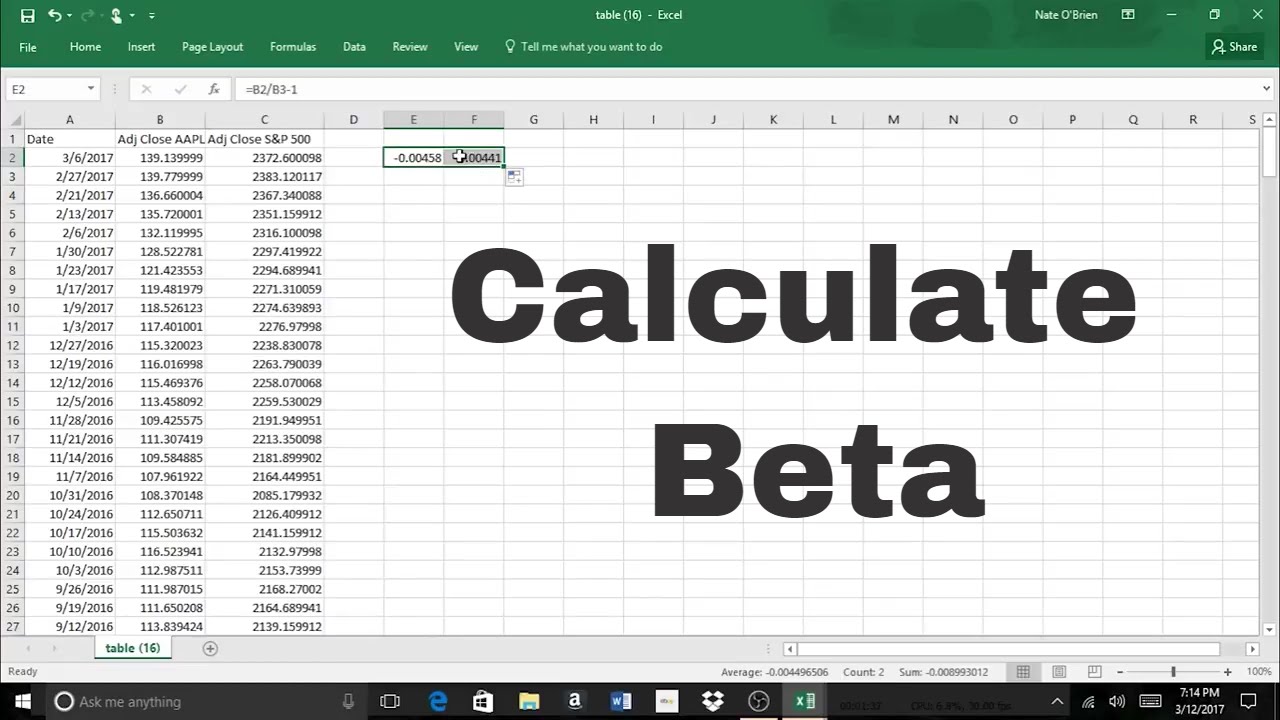

Accounting Public accounting firms consist of accountants whose job is serving business individuals governments nonprofit by preparing financial statements taxes. Slope Beta Formula SLOPEknown_ys known_xs The SLOPE function uses the following arguments. Method 1 - How to calculate beta in Excel using slope On the same worksheet as the data data must be on the same page as the formula type slopex data y data The X data is the return on the stock while the Y data is the return on the index Afterwards convert Raw Beta into Bloombergs Adjusted Beta by applying Bloombergs proprietary adjustment as follows.

Multiply the beta value by the difference between the market rate of return and the risk-free rate. Calculate beta with Excels SLOPE function assuming that XOM is the y and GSPC is the x. β Variance of Market Return Covariance of Market Return with Stock Return.

Download the excel file here. You need daily or weekly closed values for 3 or 5 years based on what beta variant you want to calculate GOOGLEFINANCEBB close 2020-51217 20201217 weekly and then input it into this equation. To calculate the covariance Calculate The Covariance Covariance is a statistical measure used to find the relationship between two assets and is calculated as the standard deviation of the return of the two assets.

To clarify Covariance is a measurement of the directional relationship between two numbers. How to calculate be. β covBB SP500varSP500 googlefinance does not support monthly so for that you need to use.

This simple yet easy to understand video provides you with the ability to ca. The beta formula is used in the CAPM model to calculate the Cost of Equity Calculate The Cost Of Equity Cost of Equity Ke is what shareholders expect for investing their equity into the firm. DB cost salvage value life of periods current period This is a great Excel function for accountants.

β a Cov r a r b Var r b. The beta can readily be computed for a stock or portfolio in a spreadsheet like Excel using opening and closing price. A spreadsheet implementing the approach is also available at the bottom of the page.

There are two ways of calculating beta with Excel the first uses the variance and covariance functions while the second uses the slope functionThe corresponding formulae are given below. Therefore the unlevered beta of GHK Ltd. This matches to within rounding error the value of 112 given.

If you want to use Excel to calculate the value of this function at x 04 this can be done with the BetaDist function as follows. For this example well use a beta value of 15. For my spreadsheet I entered SLOPED3D38E3E38 The value returned is 1119.

BETADIST 04 4 5 TRUE 0 1 This gives the result 04059136. BETADIST B3B4B5TRUEB6B7 As you can see the beta distribution for the variable x 2 comes out to be 017. The most popular use of the beta coefficient is to calculate the cost of equity in valuation modeling.

On this page we discuss the Blume adjusted beta formula and illustrate the application using a simple example. Learn how to calculate Beta on Microsoft Excel with this step-by-step tutorial.

Beta Formula Calculator For Beta Formula With Excel Template

Bloomberg Historical Beta Calculation Using Excel Amt Training

How Do You Calculate Beta In Excel

How To Calculate Beta On Excel Linear Regression Slope Tool Youtube

How To Calculate Beta With Excel Calculation Of Beta Youtube

Beta Formula Calculator For Beta Formula With Excel Template

Beta Coefficient Calculate Beta In Excel Eloquens

How To Calculate Beta In Excel

Beta Formula Calculator For Beta Formula With Excel Template

0 Response to "beta formula for finance using excel"

Post a Comment