calculating flotation costs corporate finance

Flexible pricing and great discount programs. The Clapper Corporation needs to raise 60 million to finance its expansion into new markets.

So amount raised by the firm will be number of shares outstanding multiplied by share price and then deduct direct and indirect costs.

. What is the companys weighted average cost of capital WACC. So Po 1-F is the net price per share received by the company. This reduces the projects estimated return.

The following formula is used to calculate cost of new equity. We can define flotation costs as the fees charged by investment bankers when a company is raising external capital to finance projects. This is most commonly done by incorporating flotation costs in the DCF model.

The initial offering price was 23 per share and the stock rose to 2630 per share in the first few minutes of. The initial offering price was 26 per share and the stock rose to 1950 per share in the first few minutes of trading. Adjust the cost of capital to include flotation costs.

If the offer price is 75 per share and the companys underwriters charge a 7 percent spread how many shares need to be sold. The company will sell new shares of equity via a general cash offering to raise the needed funds. The difference between the cost of new equity and the cost of existing equity is the flotation cost which is 207-200.

Under a firm commitment agreement Huff received 1505 for each of the 5 million shares sold. The first approach states that the flotation expenses must be incorporated into the calculation of a companys cost of capital. Has just gone public.

The tax rate is 30. Amount raised1 f T Amount needed after floatation costs 2228M1 f. For example a firm issuing 100 million in new equity may net only 95 million after incurring.

Cost of New Equity. Flotation Costs and Cash Flow Adjustment. The company will sell new shares of equity via a general cash offering to raise that needed funds.

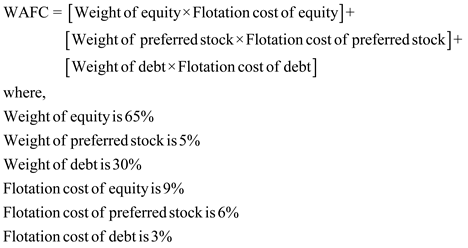

Re D1 P 01fg r e D 1 P 0 1 f g where f is the flotation cost as a percentage of the issue price. The company will sell new shares of equity via a general cash offering to raise the needed funds. These flotation costs should be incorporated in the weighted average cost of capital calculation if we want to.

The total cost of the equipment including floatation costs was. The direct costs were 1350000 and indirect costs were 210000. The cost of equity calculation after adjusting for flotation costs is.

The company will sell new shares of equity via a general cash offering to raise the needed funds. Essentials of Corporate Finance 10th Edition Edit edition Solutions for Chapter 15 Problem 7QP. Calculating Flotation Costs.

Calculating Flotation Costs the Educated Horses Corporation needs to raise 40 million to finance its expansion into new markets. The answer is 200. Under a firm commitment agreement Wiley received 2139 for each of the 775 million shares sold.

P0 is the issue price of a share of stock. Has a debt-equity ratio of 75. Ke D1Po1-F g F is the percentage flotation cost incurred in selling the new stock.

The cost of equity is 12 and the cost of debt is 7. Re D1 P 0 Fg r e D 1 P 0 F g When flotation costs are specified as a percentage applied against the price per share the cost of external equity is represented by the following equation. Flotation Costs and the Cost of Capital.

Calculating Flotation costs Suppose your company needs 6 million to build a new assembly line. When the company issues new equity it incurs a flotation cost of 10. Flotation costs are incurred by a company when it raises new capital and are typically between 2 and 6.

P 0 1 F Where D1 is dividend in next period. The initial offering price was 26 per share and the stock rose to 1950 per share. Huff paid 800000 in direct legal and other costs and 250000 in indirect costs.

Re D1 P01 - f g In the above equation the only different factor from the previous equation is f which represents flotation costs expressed as a percentage. Essentially it states that flotation costs increase a companys cost of capital. Calculating Flotation Costs The Wiley Oakley Co.

Calculating Flotation Costs the Huff Co has just gone public. Incorporate flotation costs into the cost of capital. Calculating Flotation Costs The Mudd Stereo Corporation needs to raise 20 million to finance its expansion into new markets.

The flotation costs must be treated as part of the initial investment outlay at the start of a project to correctly calculate the net present value NPV and internal rate of return IRR of the project for which funding is needed. Calculating Flotation Costs the Huff Co has just gone public. Your target debt-equity ratio is 10 The flotation cost for new equity is 15 percent but the flotation cost for debt is only 4 percent.

Calculating Flotation Costs the Huff Co has just gone public. What was the flotation cost as a percentage of funds raised. View and compare CALCULATEFLOTATIONCOST on Yahoo Finance.

To raise the necessary cash for a new project the firm may need to issue stocks bonds or other securities. F is the ratio of flotation cost to the issue price. Step-by-step solution Step 1 of 5 The firm received 3175 for 775 million shares.

However a theoretically less sound approach is to incorporate the flotation costs in cost of equity or cost of debt. If the offer price is 23 per share and the companys underwriters charge a spread of 7 percent how many shares need to be sold. The company is considering a new plant that will cost 125 million to build.

Under a firm commitment agreement Huff received 1505 for each of the 5 million shares sold. The costs of issuing these securities to the public can easily amount to 5 percent of funds raised. Problem 18 Easy Difficulty.

Calculating Flotation Costs LO3 The Meadows Corporation needs to raise 75 million to finance its expansion into new markets. Total costs 21M 128000 2228M Using the equation to calculate the total cost including floatation costs we get.

Npv Calculation Without Flotation Costs Download Table

16 Of 17 Ch 14 Flotation Costs 2 Examples Youtube

Flotation Cost Definition Formula How To Calculate

Flotation Costs Breaking Down Finance

The Actual Price Of Equity India Dictionary

Flotation Cost Definition Formula How To Calculate

Solved Calculating Flotation Costs Southern Alliance Company Need Chegg Com

Flotation Cost In Project Evaluation Calculation Example Efm

Npv Calculation Using The Traditional Consideration Of Flotation Costs Download Table

0 Response to "calculating flotation costs corporate finance"

Post a Comment